What is an IPO? Understanding the Basics

India Largest IPO: Hyundai motors offers theirs IPO. Initial Public Offering (IPO) is the process by which a private company offers its shares to the public for the first time. This transition allows the company to raise capital from public investors, which can be used for expansion, debt reduction, or other corporate purposes. Going public also increases a company’s visibility and credibility in the marketplace.

For instance, investors gain access to the company’s financial performance, governance, and growth prospects, making it an attractive opportunity.

A Historical Overview of IPOs in India.

India Largest IPO: Hyundai Motors landscape has transformed significantly since the economic liberalization in the 1990s. Initially dominated by public sector enterprises, the market has evolved to include numerous private sector companies. Noteworthy past IPOs include those of Infosys and Coal India, which set the stage for high-profile offerings.

Hyundai Motors’ IPO is particularly significant as it marks a new chapter in the Indian automotive sector, underscoring the increasing interest of international players in the Indian market.

The Journey to India’s Largest IPO: Key Milestones

India Largest IPO: Hyundai Motors journey toward becoming the largest IPO in India involved several key milestones:

- Initial Announcement: The company announced its IPO plans, generating substantial interest among investors and analysts.

- Regulatory Approvals: Obtaining necessary approvals from the Securities and Exchange Board of India (SEBI) was a critical step in the process.

- Roadshows and Investor Engagement: Hyundai conducted extensive roadshows to engage institutional and retail investors, creating excitement around the offering.

- Pricing Strategy: Setting a competitive price band that appealed to both retail and institutional investors was vital to the IPO’s success.

- Subscription Period: The IPO witnessed strong subscription rates, reflecting robust demand in the market.

IPO Size

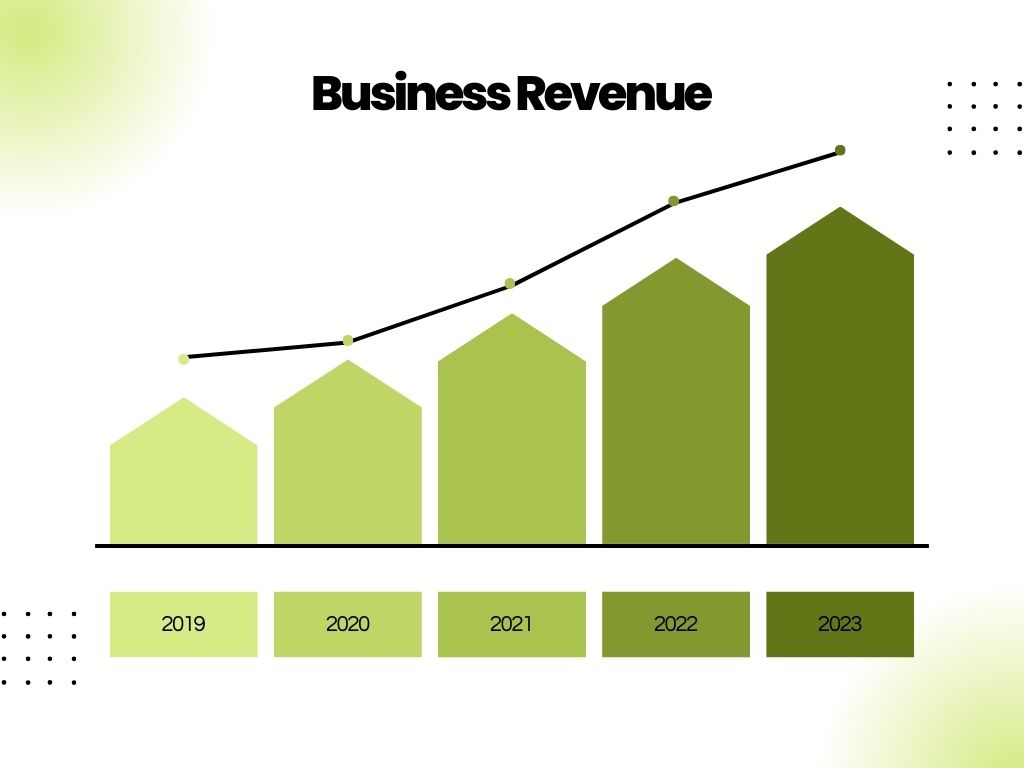

India Largest IPO: Hyundai Motors raised an impressive ₹25,000 crore (approximately $3.0 billion), making it the largest IPO in India’s history. This remarkable figure demonstrates investor confidence and the company’s growth potential.

Sector Insights: What Made This IPO Stand Out?

Hyundai Motors’ IPO stood out due to several factors:

- Market Demand: The Indian automobile sector is witnessing rapid growth, driven by increasing consumer incomes and the demand for personal vehicles.

- Strong Brand Reputation: As a leading global automotive manufacturer, Hyundai’s established reputation fostered trust among investors.

- Innovation and Sustainability: Hyundai’s commitment to electric vehicles and sustainable practices aligns with modern investors’ priorities, making it an attractive option.

- Diverse Product Portfolio: The company’s broad range of vehicles, including electric and hybrid models, positions it for sustained growth in a competitive market.

- You must be know

- India Largest IPO: Hyundai Motors

Financials at a Glance: The Numbers Behind the IPO

Here are some key financial metrics regarding Hyundai Motors’ IPO:

- Total Amount Raised: ₹25,000 crore (approximately $3.0 billion).

- Valuation: Prior to the IPO, Hyundai Motors was valued at approximately ₹1.5 lakh crore ($20 billion).

- Share Price Range: The share price was set between ₹400 and ₹450, with the final price being determined based on demand.

- Investor Demand: The IPO saw subscription rates exceeding 10 times the available shares, indicating strong interest from both institutional and retail investors.

Pingback: Cochin Shipyard Stock Hits Lower Circuit

Pingback: Ratan Tata: The Visionary Who Transformed India’s